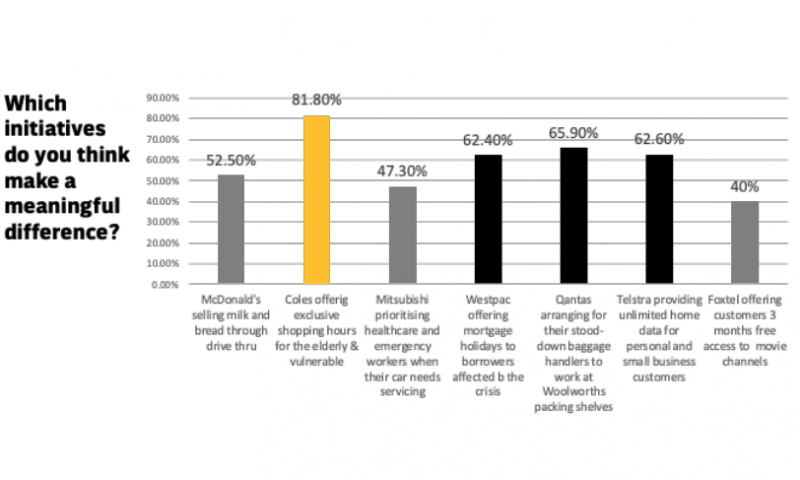

The COVID-19 brand initiative that won the most approval from Australian consumers is Coles’ community shopping hour to help the elderly and vulnerable access groceries.

Research commissioned by DDB and performed by Pureprofile on which COVID-19 initiatives were best received by consumers found Foxtel’s offer of three months of free access to its movie channels was considered to be the least meaningful.

Supermarkets’ community hours for vulnerable shoppers have been deemed to be the most meaningful brand activities.

Coles’ community hour was followed by Qantas arranging for stood down baggage handlers to work as shelf packers at Woolworths, which has also been running a dedicated shopping hour for customers. The research was conducted by Pureprofile between the 2nd and 4th of April from a group of 1011 Australian consumers. The consumers responded to a closed question survey with multiple choice answers reflecting a chosen selection of brands.

ADVERTISEMENT

Other highly rated initiatives were Westpac offering ‘mortgage holidays’ to borrowers significantly impacted by the crisis and Telstra offering unlimited home data for personal and small business customers. The research, which was provided to be a general check of consumer sentiment during this time, reflected the perception of consumers around big Australian brands who have undertaken initiatives specific to COVID-19.

DDB Sydney’s managing director of strategy and innovation, Leif Stromnes, explained that brands were being judged by the values they are exhibiting in their activities. The purpose of the survey was to find the value brands can add to their perception with Australian consumers during times like the coronavirus pandemic.

“Consumers are judging brands by their helpfulness, their actions, and the values they exhibit. Participating in the COVID-19 conversation is a double-edged sword and it is easy to get it wrong,” Stromnes said.

“Gratuitously offering messages of support is net negative. Taking proactive action as a brand, for instance, letting people know how you are operating during the crisis, is seen as helpful and relevant.

“Brands that have made a sacrifice for their customers, their communities and their staff are being rewarded. A good example of this is Westpac offering mortgage holidays for customers affected by the crisis.

“Competence and legitimacy are also important. When brands take action, it needs to be true to their expertise, such as Coles offering an exclusive hour of shopping to the elderly, the vulnerable, and front-line health workers. The size and scale of Coles, the fact that it is seen as an essential service, and its reach into every corner of the country, makes this gesture a winner,” he concluded.

Coles, Westpac and McDonald’s are clients of DDB. The agency has also previously worked with Foxtel.

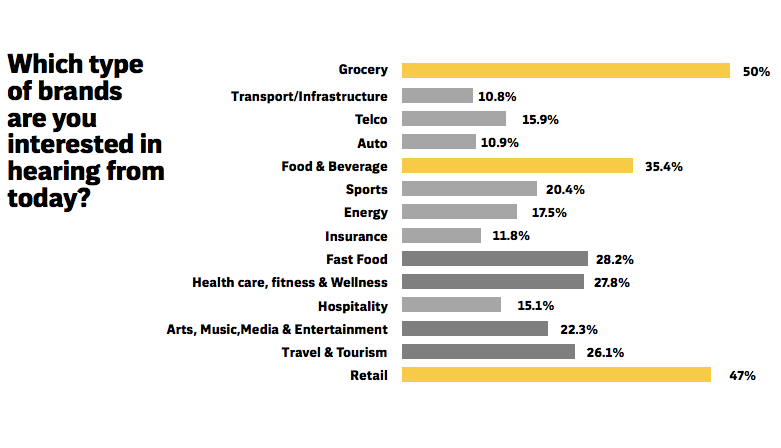

66% of respondents said they want to hear from brands at this time. Unsurprisingly, based on the result for Coles’ initiative, communications from grocers, food and beverage providers and retail outlets were the most valued by consumers. 28.2% of respondents were interested in communications from fast food outlets, and 27.8% were after correspondence from healthcare, fitness and wellness businesses.

Travel and tourism industry also rated highly, with 26.1% of respondents seeking communication from the brands in this area.

The travel and tourism industry received a surprising level of interest from consumers.

Stromnes added that brands in industries receiving the lowest interest from consumers will find advertising ‘futile’ while people remain in lockdown.

“It is difficult for brands to advertise if consumers are just not listening,” Stromnes said.

“While we are seeing very high interest in perceived essential services industries such as grocery, it is a different story for categories such as insurance and hospitality. These categories are literally ‘frozen’ by the lockdown. Under these circumstances, advertising is futile because there is no consumer relevance at all.

“But things will change. Australia will move from lockdown into a partial recovery mode, and different categories will open up and become relevant again. It is likely that things like sports, travel and tourism – local – and even hospitality will enjoy a post lockdown boom.

“When the conditions are right, advertising will be a very effective weapon. The important thing is to read the sentiment and make sure you are ready to go as soon as the conditions are right because the first-mover advantage will be huge.”

Further insights from the research also found that consumers prioritised communications from brands which detailed the measures taken to keep staff and customers safe, and how the brands are helping the vulnerable and community.

The generic ‘We’re here for you’ emails that were all-too-common in March rated the lowest on a scale of what brands should be doing for consumers.

The financial impact of the crisis on consumers’ wallets was also apparent in the research, with 75.4% of consumers still interested in hearing about brand deals and offers.

Stromnes said: “Brands that are sensitive to people’s emotional state are winning.

“As we move from lockdown into a slow recovery phase, brands will have the opportunity to be more playful, and if it’s true to their personality, even humorous.

“Inevitably, as we start to enjoy some new-found freedoms, brands that are in-tune with customer sentiment will find an emotional sweet spot that will pay back handsomely.”