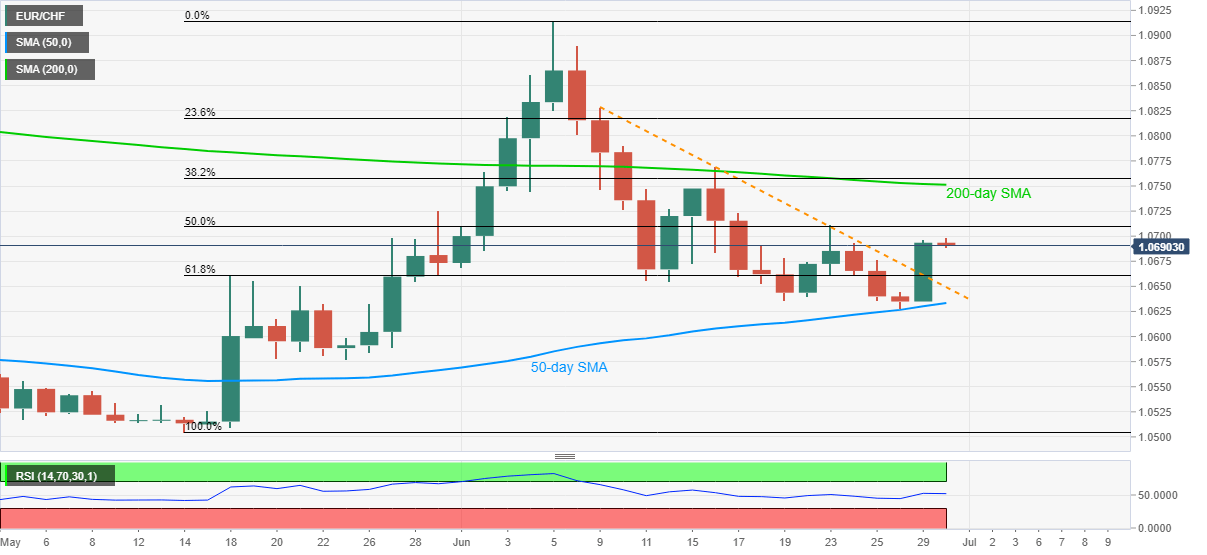

- EUR/CHF struggles to extend the upside break of three-week-old falling trend line.

- 50% Fibonacci retracement, 200-day SMA are on the buyers’ watchlist.

- Sellers may not risk entries unless breaking 50-day SMA.

- Normal RSI conditions, sustained bounce from key SMA signal further upside.

EUR/CHF takes rounds to 1.0690 while heading into the European session on Tuesday. In doing so, the pair seesaws around weekly top following its successful break of a trend line stretched since June 09. Though, buyers seem to lose upside momentum strength near the 1.0700 threshold.

Other than the 1.0700 psychological magnet, 50% Fibonacci retracement level of May-June upside, at 1.0710, also questions the pair’s further upside. Additionally, 200-day SMA near 1.0750 acts as an extra resistance for the pair traders to watch.

In a case where the bulls dominate past-1.0750, 1.0770 and 1.0820 might act as buffers before targeting a fresh monthly high beyond the present one around 1.0915.

On the contrary, 61.8% Fibonacci retracement level of 1.0660 can offer the closest support during the pair’s fresh weakness, a break of which will highlight the resistance-turned-support line, at 1.0650, followed by 50-day SMA level of 1.0633.

Given the pair’s extra fall past-1.0633, the May 25 low near 1.0575 could lure the bears.

EUR/CHF daily chart

Trend: Bullish