- Monero reverses recent gains amid technical correction.

- Pivot to privacy may have lent support to XMR.

- Evening Star may signal a reversal towards $50.00.

Monero (XMR) bulls hit a brick wall on the approach to $60.00. The coin topped at $60.12 during early Asian hours and reversed to $57.78 by press time. Despite 1.4% decline on Wednesday, Monero is the best-performing altcoin on the week-on-week basis: XMR/USD value increased by over 27% in recent seven days.

Monero’s market capitalization surpassed $1 billion threshold, and the coin made its way to the top-ten altcoins my market value, passing Stellar (XLM), Cardano (ADA) and Tezos (XTZ).

Pivot to privacy

While regulators and politicians are wary about privacy coins, the crytocurrency industry seems to have another point of view on the matter. Thus, several prominent figures of the crypto community, including John MacAfee and Coinbase’s CEO, Brian Armstrong recently agured that anonumity-focused coins would make thheir way to the mainstream as they serve the basic needs of privacy.

Brian Armstrong, the head of the US-based cryptocurrency exchange Coinbase, wrote in hist 2020s predictions:

“I believe we’ll eventually see a “privacy coin” or blockchain with built in privacy features get mainstream adoption in the 2020s.”

XMR/USD: technical picture

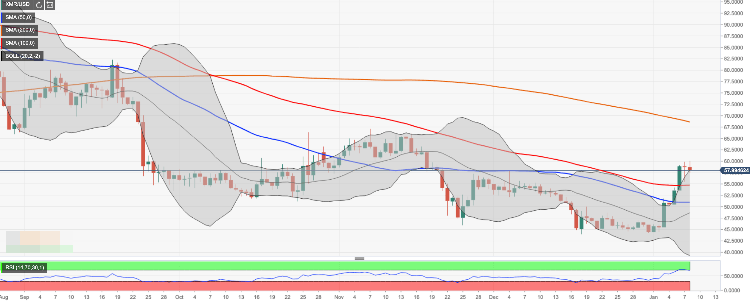

XMR/USD has created a double-top formation on the 4-hour chart with the neckline on approach to $55.00. From the short-term point of view, this area is critical for Monero’s further momentum as it is reinforced by SMA100 (Simple Moving Average) daily. A sustainable move below will signal that thee downside correction is gaining force with the next focus at the key support at $51.00. This barrier is created by the lower line of 4-hour Bollinger Band and SMA50 daily and it separates us from psychological $50.00.

The daily RSI (Relative Strength Index) has slowed down on approach to an overbought territory. The indicator signals that the downside correction is on the way. An Evening Star candlestick formation on a daily chart also implies that the coin may be ready to start a trip to the South.

On the upside, a strong move above $60.00 is needed to allow for an extended recovery with the next aim at $67.00, which is the highest level since the beginning of November 2019, and $68.70 (SMA200 daily). The last time XMR traded above SMA200 daily in September 2019.